IS YOUR SUPPLY CHAIN PROTECTED AGAINST FRAUD?

The Association of Certified Fraud Examiners definition to fraud is “the use of one’s occupation for personal enrichment through the deliberate misuse or misapplication of the employing organisation’s resources or assets.”

Nowadays, the desire to advance quickly and be successful is common among us. Commonly, employees with greed mindset are the most desired in companies. Contradictory, the pressure involved in this mentality is one of the elements that can lead employees to commit fraud.

According to social-psychological studies led by Donald Cressey (*Why Do Trusted Persons Commit Fraud? A Social-Psychological Study of Defalcators), trusted persons are attempted to become violators when they face:

· Pressure: Motivation or incentive to commit fraud that can occur in the workplace or personal lives. The first most common type of pressure emerges from financial desire to quickly achieve social status, while the second derives from uncontrollable financial debts.

· Rationalization: Justification of dishonest actions. Varys according to personal beliefs, nevertheless, the most common occurrence is linked to the non-fulfilled expectation for monetary recognition for the business growth.

· Opportunity: The knowledge and ability to carry out fraud. The thorough understanding of the organisation’s procedures and the certainty that the risk of being caught is scanty creates an opportunity to commit fraud.

This theory became well-known as “The fraud triangle.”

The company is vulnerable to the occurrence of fraud when these three critical elements are simultaneously present. Ergo, to minimize the likelihood of fraud occurrence, it is crucial to remove one or more of these elements.

Hence, how can the supply chain be protected against fraud?

All sectors of the program are subject to fraud risks. A broad understanding of the business and the context in which it incentivizes contributes to avoiding vulnerability. Of equal significance, though, is the awareness of the constant possibility of its occurrences.

The supply chain encompasses a wide range of processes in which evolves orders, inventory management, transport, customer service, purchases, packing, storage, treatment of the goods, information management and customs duty management. As supply chain evolves different stages, its complexity requires proper attention in what refers to fraud risks control.

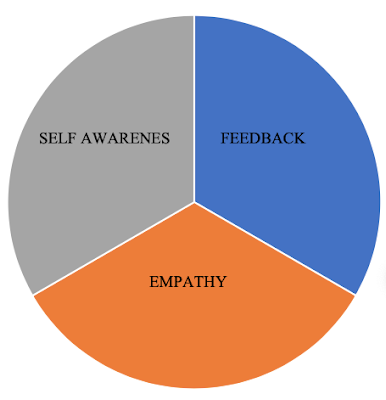

Implementing an anti-fraud programme can be anchored by the assembling of the right team and the facilitation of group discussion sessions and document observation. Those practices can design an opportunity to identify and catalogue possible fraud scenarios, which can support anticipating and preventing their occurrences.

Those periodic assessment controls can help management understanding the unique risks related to every stage of the supply chain and identify weaknesses in every related activity. As the assessment might quest insight across all process, it is useful for rearrange ideas and adapt them to realistic planning for targeting the right resources and priorities.

Subsequently, a healthy corporate culture that shape and tailor the control environment and incentive employees to adopt a positive attitude and behave with responsibility can narrow the chances of fraud. At the same time, a code of ethics that includes conflicts of interest declaration and gifts declaration to incentivize whistle-blowing policies can provide support to minimize the risk scenario.

Factors identified as fraud risk factors are those pointed out as weaknesses that the companies may avoid having as it creates pressure, opportunity, and reasonability. Examples of those factors are:

· uncertainty about internal control, e.g., inaccuracy about responsibility and competence of the different managers and departments

· low perception of the external environment, such as new tendencies of the industry, new financial regulations, market saturation, new technologies, increased competition.

· lose control of the operating characteristics by missing the track of the company´s profitability and its general financial condition.

To avoid opportunity, companies may, therefore, consume particular attention to the management structure and surveillance, preserving clear rules constructed to punish all fraud initiatives. In the final analysis, to avoid rationalization and pressure, the company may not only open space for dialogue but also create a system of rewards that fulfil the employees’ desire for recognition. As the business growth, fair enough, the company may recompense the hard work from its employees.

To illustrate this or other texts on this site, if you consider yourself or your company a visionary, welcome contacting me: It will be a pleasure to highlight your visionary moves toward a better business world.

Thanks for the good words! Really appreciated. Great post. I’ve been commenting a lot on a few blogs recently, but I hadn’t thought about my approach until you brought it up.

ReplyDeleteInterior Designers in Chennai

Pooja Room Interior Designers in Chennai

Modular Kitchen Interior Designers in Chennai

False Ceiling Interior Designers in Chennai

Tv Showcase Interior Designers in Chennai

Cupboard and Wardrobe Interior Designers in Chennai

Bedroom Interior Designers in Chennai

Living Room Interior Designers in Chennai